Process Innovation

- The ACHEMA

- For Exhibitors

-

For Visitors

-

Magazine

- Overview

-

Photo Gallery

- Digital Hub

- Engineering

- Events

- Exhibition Grounds

- Industrial and Labour Safety

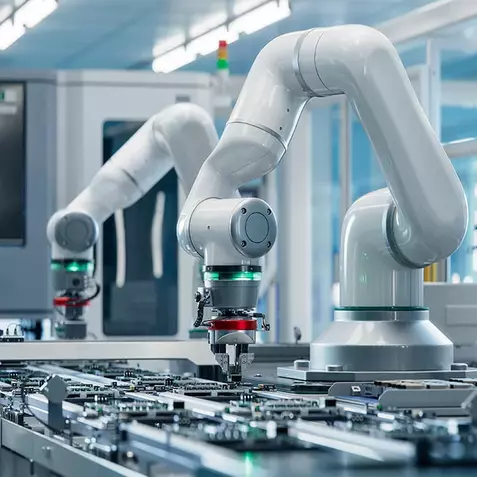

- Instrumentation, Control and Automation Techniques

- Laboratory and Analytical Techniques

- Literature, Information, Learning and Teaching Aids

- Materials Technology and Testing

- Mechanical Processes

- Pharmaceutical, Packaging and Storage Techniques

- Pumps, Compressors, Valves and Fittings

- Research and Innovation

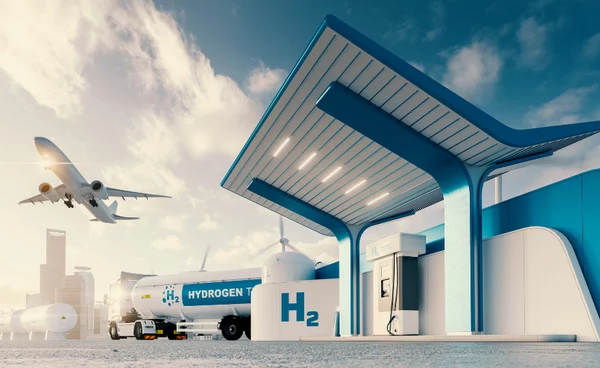

- Special Show Hydrogen

- Thermal Processes

- Media Library

- Process Innovation

- Pharma Innovation

- Green Innovation

- Lab Innovation

- Digital Innovation

- Hydrogen Innovation

- The Show

- Search

- Press

- Language

-

Login

How do you want to sign in?

As visitor / participant

With your personal myACHEMA account you have access to all extended features of ACHEMA online and to services associated with your participation in our events.

Login with your myACHEMA account to participate in ACHEMA and for access to the ticket shop.

No myACHEMA account yet?

As exhibitor

The ACHEMA Exhibitor Portal provides all information, documents and services for your ACHEMA 2027 participation.

Your login benefits

Save Bookmarks

Add notes

Export entries

Buy tickets

- The ACHEMA

- For Exhibitors

-

For Visitors

-

Magazine

- Overview

-

Photo Gallery

- Digital Hub

- Engineering

- Events

- Exhibition Grounds

- Industrial and Labour Safety

- Instrumentation, Control and Automation Techniques

- Laboratory and Analytical Techniques

- Literature, Information, Learning and Teaching Aids

- Materials Technology and Testing

- Mechanical Processes

- Pharmaceutical, Packaging and Storage Techniques

- Pumps, Compressors, Valves and Fittings

- Research and Innovation

- Special Show Hydrogen

- Thermal Processes

- Media Library

- Process Innovation

- Pharma Innovation

- Green Innovation

- Lab Innovation

- Digital Innovation

- Hydrogen Innovation

- The Show

- Search

- Press

- Language

- Login

How do you want to sign in?

As visitor / participant

With your personal myACHEMA account you have access to all extended features of ACHEMA online and to services associated with your participation in our events.

Login with your myACHEMA account to participate in ACHEMA and for access to the ticket shop.

No myACHEMA account yet?

As exhibitor

The ACHEMA Exhibitor Portal provides all information, documents and services for your ACHEMA 2027 participation.